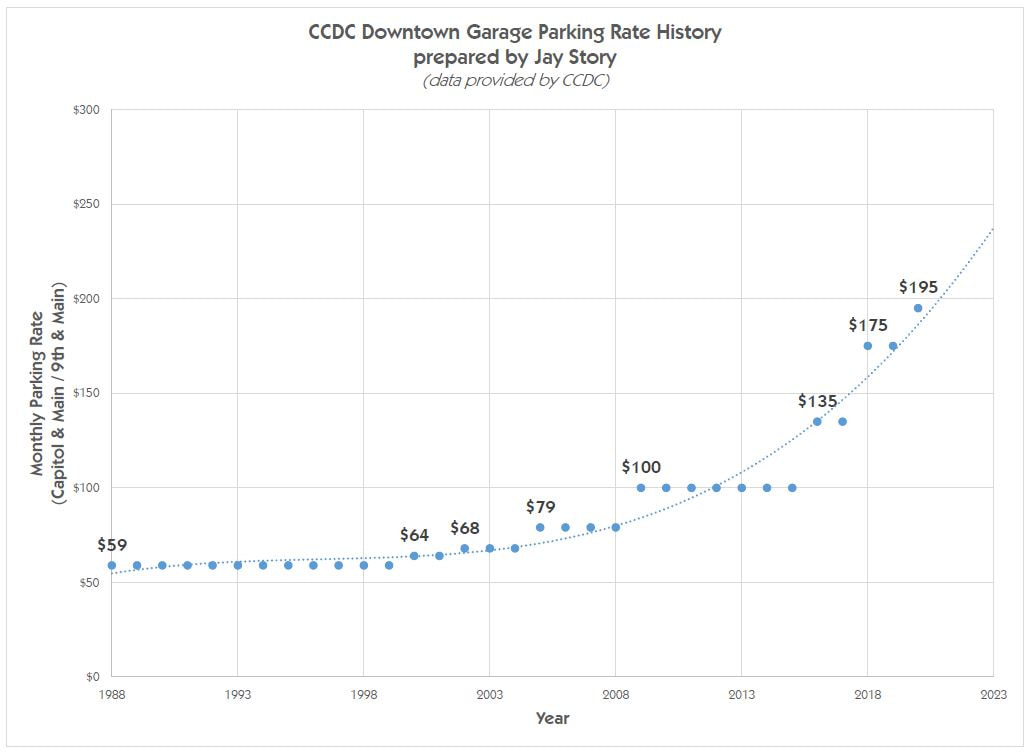

Fast forward to the next 11 years, where parking rates jumped from $79/month to $195/month, and you'll see parking rates have been increasing at an annualized rate of 6.3%. Take a look at the table and trend line below, and you may start wondering where opportunities lie. Is it in providing parking? Buying property near transit centers? Should I make my development more bicycle friendly and close to amenities?

RSS Feed

RSS Feed